Daily Productive Sharing 100 - How to Understand the Macroeconomics of America?

(The English version follows)

今天刚好是 Daily Productivity Sharing 的第一百期。老实说,刚开始的时候,还是抱着试试看的态度,不确定自己坚持多久。一转眼,四个月过去了,整个系统也慢慢搭建起来:

- 一开始只是简单地导语 + 链接,到现在导语 + 重点摘要 + 链接;

- 一开始只有文章分享,到现在的文章分享 + 好书推荐与摘要;

- 一开始总是焦虑没有好内容,到现在提前准备至少一周的内容;

- 一开始只有大家的订阅支持,到现在不光有订阅支持,还有付费支持。

根据大家之前的投票结果,未来的 Daily Productivity Sharing 会按照主题准备:

周一 - 时间管理技巧

周二 - 阅读技巧

周三 - 笔记技巧

周四 - 职场生产力

周五 - 其他生产力相关内容(高效人士等,可能包含增值内容)

周六 - 书摘 (增值内容)

周日 - 人肉翻墙分享 (增值内容)

也欢迎大家建议其他话题:)

今天的分享讨论美国的宏观经济,是一篇非常值得一读的长文(差不多需要一个多小时)。

- 二十世纪三十年代,美国政府强迫公民把黄金卖给政府,从而建立了巨量的金融储备;

- 二战期间,美国因为远离主战场,从而成为众多国家首选的避难地,所以很多国家将黄金准备转移至美国保管,从而将美国的黄金储量提升至世界第一;

- 1974年,美国与沙特达成协议,石油买卖需要使用美元支付,从而建立了新的石油美元体系,取代了之前的布雷顿森林体系。美国通过这一协议巩固了美元地位,而 OPEC 各国通过这一协议获得美国的保护与合作;

- 2000年,萨达姆首次使用欧元支付取代美元支付来卖石油;

- 中印俄越来越多地使用欧元/人民币来取代美元作为跨境支付的手段,慢慢降低了美元的地位;

- 中国的美元储备降低很大程度上是有意为之,之前通过购买美元债券来降低对美贸易顺差,但是这一措施自2013年就停止了;

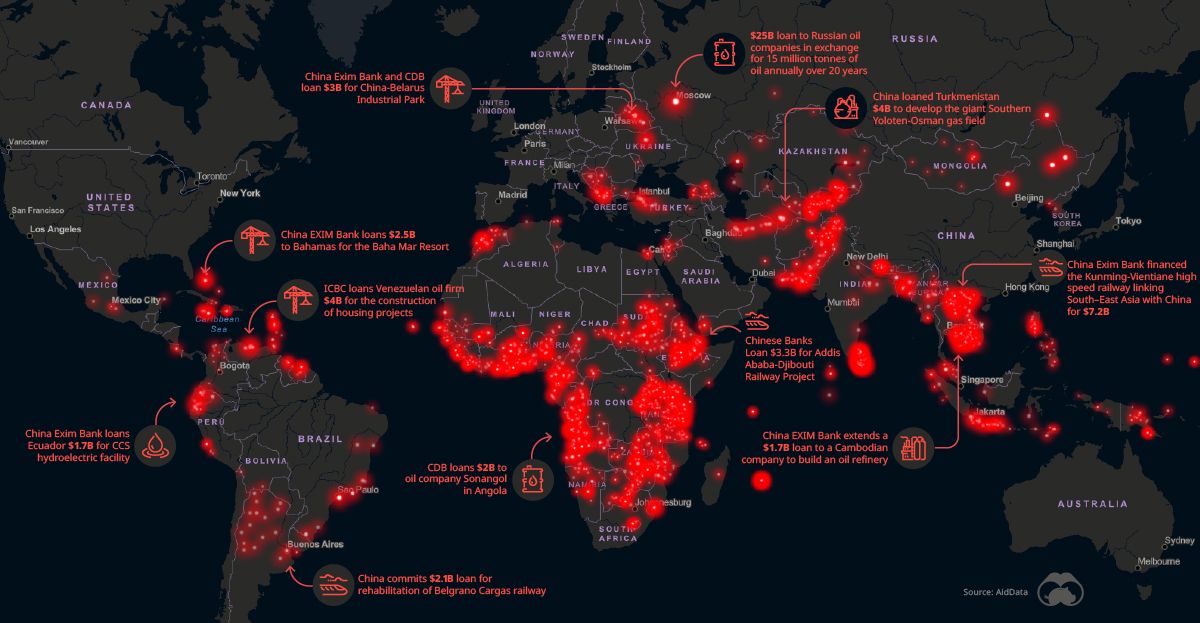

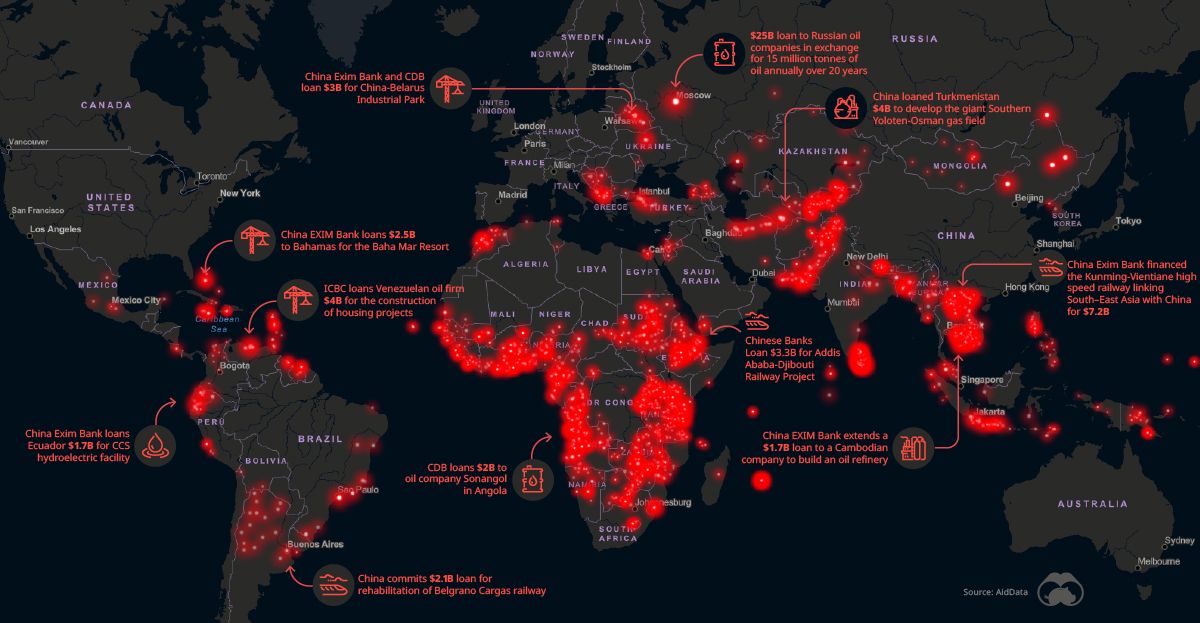

- 通过一带一路,中国可以选择让借款方还款,也可以让无力还款的借款方将项目所有权转让给中国,可谓一箭双雕;

Taking my view a step further, evidence shows that the global monetary system as currently structured is gradually re-aligning itself, and this fact will have important ramifications for investments over the long run.

Ironically, it’s often not an external threat that brings down the existing order; it’s the flaws within the system that, left unchecked, eventually expand enough to bring it down and necessitate a re-ordering, either from the same ruling regime or from a new regime that displaces it.

Each system mostly unraveled from within rather than being brought down externally, and each time one system transitioned to another, a significant and widespread currency devaluation occurred.

In the 1930’s, the United States government made gold ownership illegal and forced citizens to sell their gold to the government, which allowed the government to build up huge gold reserves.

Ultimately, all major currencies including the dollar devalued radically vs gold and other hard assets in the 1970’s.

Fiat currency is a monetary system whereby there is nothing of value in the currency itself; it’s just paper, cheap metal coins, or digital bits of information.

A country can enforce the usage of a fiat currency as a medium of exchange and unit of account within their country by making all taxes payable only in that currency, or by enacting other laws to add friction to, or in some cases outright ban, other mediums of exchange and units of account.

In 1974, however, the United States and Saudi Arabia reached an agreement, and from there, the world was set on the petrodollar system; a clever way to make a global fiat currency system work decently enough.

With the petrodollar system, Saudi Arabia (and other countries in OPEC) sell their oil exclusively in dollars in exchange for US protection and cooperation.

And, all of these countries store excess dollars as foreign-exchange reserves, which they mostly put into US Treasuries to earn some interest.

In return, the United States uses its unrivaled blue-water navy to protect global shipping lanes, and preserve the geopolitical status quo with military action or the threat thereof as needed.

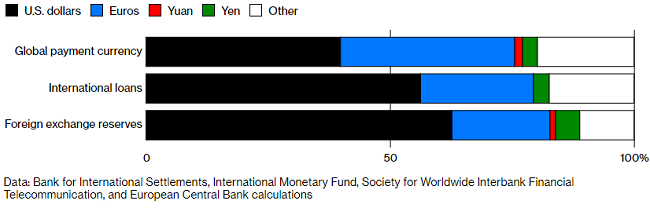

Even though the United States represented only about 11% of global trade and 24% of global GDP in early 2018, the dollar’s share of global economic activity was far higher at 40-60% depending on what metric you look at, and this gap represents its status as the global reserve currency, and the key currency for global energy pricing.

However, because the petrodollar system creates persistent international demand for the dollar, it means the US trade deficit never is allowed to correct and balance itself out.

Since currencies around the world are fiat with floating exchange rates, many countries try to keep their own currencies weak, so that they have a positive trade balance with the United States and other trading partners.

Americans who work around finance, government, healthcare, and technology get many of the benefits of living in the hegemonic power, without the drawbacks.

The dollar cycle is based on major shifts in monetary and fiscal policy, as well as the resulting capital flows for global money that wants to chase whatever area of the world is doing well.

At first, countries needed dollars so that they could get oil. After decades of that, with so much international financing happening in dollars, now countries need dollars so they can service their dollar-denominated debts. So, the dollar is backed by both oil and dollar-denominated debts, and it’s a very strong self-reinforcing network effect.

During a strong dollar period, the global economy often slows, and nations get squeezed by dollar-denominated debts.

In a strong dollar environment, US exports become less competitive, and the overall global trade environment becomes sluggish, resulting in domestic stagnation within the US as well.

However, the COVID-19 pandemic hit in early 2020, which halted global trade and contributed (along with a structural oil oversupply issue) to a collapse in oil prices. The dollar quickly spiked, foreigners began outright selling Treasuries and other US assets to get dollars, causing the Treasury market to become very illiquid and “ceasing to function effectively” as the Fed described it.

In addition, China is now the world’s largest importer of commodities, rather than the United States. It’s challenging to maintain a system of all oil and most commodities being priced worldwide in US dollars if there is a bigger global trade partner and importer of oil and commodities than the United States.

The global energy market, and more broadly international trade, is now too big to be priced primarily in the currency of a country that represents this small of a share of global GDP.

As the US economy represents a smaller and smaller share of global GDP over time, it becomes increasingly unable to supply enough dollars for the world to price all energy in dollars.

There’s no country or currency group big enough to do that alone anymore. Not the United States, not China, not the European Union, and not Japan.

Six years ago, Russian exports to China were over 98% dollar based. As of early 2020, it’s only 33% dollar-based, 50% euro-based, and 17% with their own currencies.

Six years ago, Russian exports to Europe were 69% dollar-based and 18% euro-based. Now they’re 44% dollar-based and 43% euro-based.

Back in 2000, Saddam Hussein began selling oil priced in the newly-created euro.

However, when major powers like China, Russia, and India begin pricing things outside of the dollar-based system and using their currencies for trade, including for energy in some cases, the US can’t realistically intervene militarily, and instead can only intervene with sanctions or trade disputes and other forms of geopolitical pressure.

But then, China broke the wheels. Back in 2013, China declared that it was no longer in their interest to keep accumulating Treasuries. They kept running huge trade surpluses with the United States, and had dollars still coming in, but they would no longer recycle those to fund US fiscal deficits by buying Treasuries.

Many of those foreign loans, if defaulted on, mean that China gains ownership of the infrastructure. So, whether the loans are successful or not, China gains access to commodity deals, trading partners, and hard assets around the world.

Back on March 2, 2018, President Trump tweeted that “trade wars are good and easy to win”. Since then, the US trade deficit increased, rather than decreased. Trade wars are very difficult for the US to win within the petrodollar system as currently structured.

Foreigners begin selling some of their $42 trillion in dollar-denominated assets to get dollars, and that crashes US markets along with everything else, which forces the Fed to step in, print dollars to buy what they sell, and open dollar swap lines to foreign central banks, until sufficient global dollar liquidity is restored.

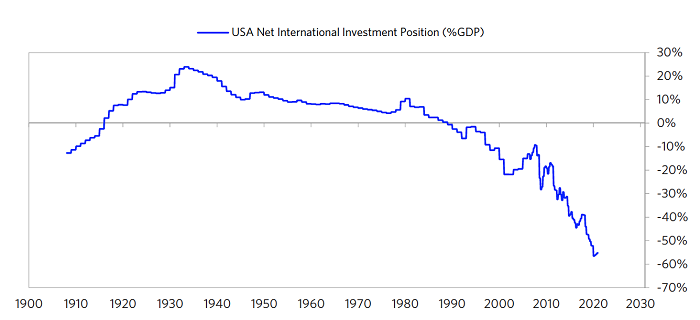

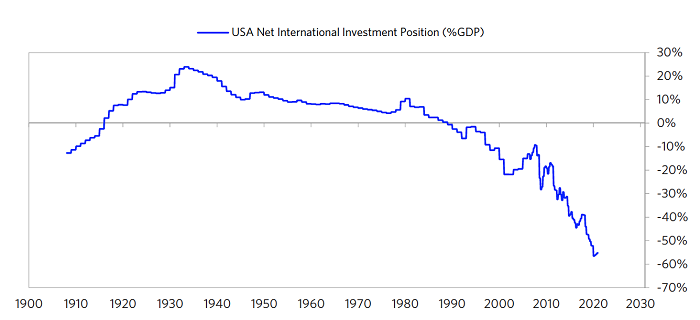

The US net international investment position has absolutely collapsed, with the US having gone from being the world’s largest creditor nation to the world’s largest debtor nation:

CEOs used to make 20x as much as the average worker in 1965, and that ratio moved up to 59x by 1989, 122x by 1995, and in recent decades has been well over 200x as much as the average worker.

At first, having the global reserve currency is an exorbitant privilege, because the benefits of hegemonic power outweigh the costs of maintaining the system. Over time, however, the upside benefits stay relatively static, while the costs keep compounding over time, until the costs outweigh the benefits.

If an increasing share of global trade, particularly within Eurasia and particularly regarding energy and commodities, keeps shifting towards euros, yuan, and rubles and away from the dollar, then the system can become more decentralized over time.

If a country’s own currency weakens, their central bank can sell some of its foreign-exchange reserves and buy its own currency. This reduces supply and increases demand for their own currency, strengthening it

The US itself doesn’t have much foreign exchange reserves. Emerging markets often have the biggest reserves, since they need them the most, but a handful of developed nations also have huge reserves as well, and just about every country has more reserves as a percentage of GDP than the United States.

Whatever form it takes, it’ll be decentralized in the sense that it won’t be completely tied to any one country’s currency, since no country is big enough for that anymore. It’ll be based around neutral reserve assets, and/or a more regional-reserve model based on a handful of key country currencies, with an expanded variety of payment channels.

At the heart of all of these systems would be the fact that the dollar would no longer be the world’s only currency for energy pricing.

In this sense, the world moves from a “global reserve currency” to a handful of “regional reserve currencies”.

This year, the largest commodity companies in the world, BHP, Vale, and Rio Tinto, all completed blockchain sales of iron ore to Chinese firms.

The Fraying of the US Global Currency Reserve System

如果你想更好地管理时间,并且减轻自己的压力,不妨试试 BRNR List

如果你也想成为更高效的人,欢迎加入我们的 TG group

也欢迎订阅我们的 TG channel

Today is the 100th edition of Daily Productivity Sharing. To be honest, when I first started, I was still trying it out, not sure how long I would keep posting. Four months have passed and the whole system has been slowly built up.

- at the beginning it was just a simple introduction + links, now it is introduction + key summary + links.

- at the beginning, there were only articles, now there are articles + book recommendations and excerpts.

- at the beginning there was always anxiety about not having good content, to now we prepare content at least a week in advance.

- at the beginning, there was only subscription support from you, now there is not only subscription support, but also paid support.

According to your previous poll results, the future Daily Productivity Sharing will be prepared according to the following topics.

- Monday - Time Management Tips

- Tuesday - Reading Skills

- Wednesday - Note Taking Skills

- Thursday - Workplace Productivity

- Friday - Other productivity related content (productive profile, etc., may include paid content)

- Saturday - Book Excerpts (paid content)

- Sunday - How to immigrate (paid content)

Feel free to suggest other topics as well :)

Today's share discusses macroeconomics in the US, which is a very long article worth reading (it takes more than an hour or so).

- In the 1930s, the U.S. government forced citizens to sell gold to the government, thus building up huge financial reserves.

- During World War II, the United States was far from the main battlefield and thus became the preferred place of refuge for many countries, so many countries prepared to transfer their gold to the United States for safekeeping, thus raising the United States' gold reserves to the first in the world.

- In 1974, the U.S. reached an agreement with Saudi Arabia that oil sales and purchases would need to be paid in U.S. dollars, thus establishing a new petrodollar system that replaced the previous Bretton Woods system. The U.S. consolidation of the dollar through this agreement, and the OPEC countries gaining U.S. protection and cooperation through this agreement.

- In 2000, Saddam used euro payments instead of dollar payments to sell oil for the first time.

- The increasing use of the euro/yuan by China, India and Russia to replace the dollar as a means of cross-border payment, slowly reducing the dollar's position.

- That China's lower dollar reserves were largely intentional, having previously reduced its trade surplus with the United States by buying dollar bonds, but this measure has been discontinued since 2013.

- That through the Belt and Road, China has the option to have borrowers repay the loans or to have borrowers who cannot repay transfer ownership of the projects to China, killing two birds with one stone.

Taking my view a step further, evidence shows that the global monetary system as currently structured is gradually re-aligning itself, and this fact will have important ramifications for investments over the long run.

Ironically, it’s often not an external threat that brings down the existing order; it’s the flaws within the system that, left unchecked, eventually expand enough to bring it down and necessitate a re-ordering, either from the same ruling regime or from a new regime that displaces it.

Each system mostly unraveled from within rather than being brought down externally, and each time one system transitioned to another, a significant and widespread currency devaluation occurred.

In the 1930’s, the United States government made gold ownership illegal and forced citizens to sell their gold to the government, which allowed the government to build up huge gold reserves.

Ultimately, all major currencies including the dollar devalued radically vs gold and other hard assets in the 1970’s.

Fiat currency is a monetary system whereby there is nothing of value in the currency itself; it’s just paper, cheap metal coins, or digital bits of information.

A country can enforce the usage of a fiat currency as a medium of exchange and unit of account within their country by making all taxes payable only in that currency, or by enacting other laws to add friction to, or in some cases outright ban, other mediums of exchange and units of account.

In 1974, however, the United States and Saudi Arabia reached an agreement, and from there, the world was set on the petrodollar system; a clever way to make a global fiat currency system work decently enough.

With the petrodollar system, Saudi Arabia (and other countries in OPEC) sell their oil exclusively in dollars in exchange for US protection and cooperation.

And, all of these countries store excess dollars as foreign-exchange reserves, which they mostly put into US Treasuries to earn some interest.

In return, the United States uses its unrivaled blue-water navy to protect global shipping lanes, and preserve the geopolitical status quo with military action or the threat thereof as needed.

Even though the United States represented only about 11% of global trade and 24% of global GDP in early 2018, the dollar’s share of global economic activity was far higher at 40-60% depending on what metric you look at, and this gap represents its status as the global reserve currency, and the key currency for global energy pricing.

However, because the petrodollar system creates persistent international demand for the dollar, it means the US trade deficit never is allowed to correct and balance itself out.

Since currencies around the world are fiat with floating exchange rates, many countries try to keep their own currencies weak, so that they have a positive trade balance with the United States and other trading partners.

Americans who work around finance, government, healthcare, and technology get many of the benefits of living in the hegemonic power, without the drawbacks.

The dollar cycle is based on major shifts in monetary and fiscal policy, as well as the resulting capital flows for global money that wants to chase whatever area of the world is doing well.

At first, countries needed dollars so that they could get oil. After decades of that, with so much international financing happening in dollars, now countries need dollars so they can service their dollar-denominated debts. So, the dollar is backed by both oil and dollar-denominated debts, and it’s a very strong self-reinforcing network effect.

During a strong dollar period, the global economy often slows, and nations get squeezed by dollar-denominated debts.

In a strong dollar environment, US exports become less competitive, and the overall global trade environment becomes sluggish, resulting in domestic stagnation within the US as well.

However, the COVID-19 pandemic hit in early 2020, which halted global trade and contributed (along with a structural oil oversupply issue) to a collapse in oil prices. The dollar quickly spiked, foreigners began outright selling Treasuries and other US assets to get dollars, causing the Treasury market to become very illiquid and “ceasing to function effectively” as the Fed described it.

In addition, China is now the world’s largest importer of commodities, rather than the United States. It’s challenging to maintain a system of all oil and most commodities being priced worldwide in US dollars if there is a bigger global trade partner and importer of oil and commodities than the United States.

The global energy market, and more broadly international trade, is now too big to be priced primarily in the currency of a country that represents this small of a share of global GDP.

As the US economy represents a smaller and smaller share of global GDP over time, it becomes increasingly unable to supply enough dollars for the world to price all energy in dollars.

There’s no country or currency group big enough to do that alone anymore. Not the United States, not China, not the European Union, and not Japan.

Six years ago, Russian exports to China were over 98% dollar based. As of early 2020, it’s only 33% dollar-based, 50% euro-based, and 17% with their own currencies.

Six years ago, Russian exports to Europe were 69% dollar-based and 18% euro-based. Now they’re 44% dollar-based and 43% euro-based.

Back in 2000, Saddam Hussein began selling oil priced in the newly-created euro.

However, when major powers like China, Russia, and India begin pricing things outside of the dollar-based system and using their currencies for trade, including for energy in some cases, the US can’t realistically intervene militarily, and instead can only intervene with sanctions or trade disputes and other forms of geopolitical pressure.

But then, China broke the wheels. Back in 2013, China declared that it was no longer in their interest to keep accumulating Treasuries. They kept running huge trade surpluses with the United States, and had dollars still coming in, but they would no longer recycle those to fund US fiscal deficits by buying Treasuries.

Many of those foreign loans, if defaulted on, mean that China gains ownership of the infrastructure. So, whether the loans are successful or not, China gains access to commodity deals, trading partners, and hard assets around the world.

Back on March 2, 2018, President Trump tweeted that “trade wars are good and easy to win”. Since then, the US trade deficit increased, rather than decreased. Trade wars are very difficult for the US to win within the petrodollar system as currently structured.

Foreigners begin selling some of their $42 trillion in dollar-denominated assets to get dollars, and that crashes US markets along with everything else, which forces the Fed to step in, print dollars to buy what they sell, and open dollar swap lines to foreign central banks, until sufficient global dollar liquidity is restored.

The US net international investment position has absolutely collapsed, with the US having gone from being the world’s largest creditor nation to the world’s largest debtor nation:

CEOs used to make 20x as much as the average worker in 1965, and that ratio moved up to 59x by 1989, 122x by 1995, and in recent decades has been well over 200x as much as the average worker.

At first, having the global reserve currency is an exorbitant privilege, because the benefits of hegemonic power outweigh the costs of maintaining the system. Over time, however, the upside benefits stay relatively static, while the costs keep compounding over time, until the costs outweigh the benefits.

If an increasing share of global trade, particularly within Eurasia and particularly regarding energy and commodities, keeps shifting towards euros, yuan, and rubles and away from the dollar, then the system can become more decentralized over time.

If a country’s own currency weakens, their central bank can sell some of its foreign-exchange reserves and buy its own currency. This reduces supply and increases demand for their own currency, strengthening it

The US itself doesn’t have much foreign exchange reserves. Emerging markets often have the biggest reserves, since they need them the most, but a handful of developed nations also have huge reserves as well, and just about every country has more reserves as a percentage of GDP than the United States.

Whatever form it takes, it’ll be decentralized in the sense that it won’t be completely tied to any one country’s currency, since no country is big enough for that anymore. It’ll be based around neutral reserve assets, and/or a more regional-reserve model based on a handful of key country currencies, with an expanded variety of payment channels.

At the heart of all of these systems would be the fact that the dollar would no longer be the world’s only currency for energy pricing.

In this sense, the world moves from a “global reserve currency” to a handful of “regional reserve currencies”.

This year, the largest commodity companies in the world, BHP, Vale, and Rio Tinto, all completed blockchain sales of iron ore to Chinese firms.

Try our sustainable productivity tool BRNR List

Comments ()